CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

How to Trade using Oscillators

Learn Forex Trading

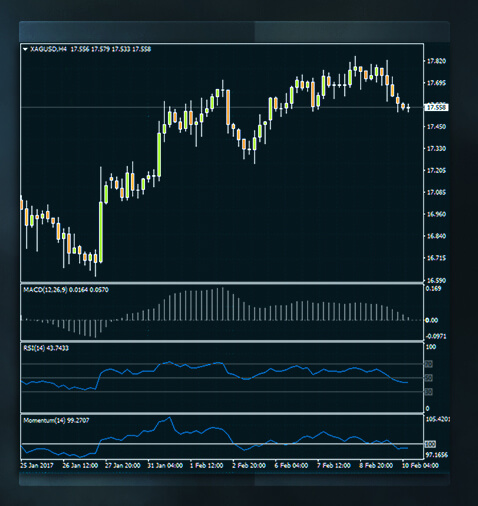

Using oscillators is very prominent in the world of trading, whether you are just beginning or have been trading professionally for years. Oscillators are based on math formulas and are categorized as inductive statistics. In forex, they make up a vital part of technical analysis since they are used to confirm market trends, signal when a trade is being overbought or oversold under extreme conditions, and also inform the trader when the market’s movement is about to reverse due to loss of momentum.

Common Practice with Oscillators

Most types of oscillators swing close to the baseline, as they are rooted near the bottom of a price chart. The baseline will undoubtedly vary depending on the oscillator and the mathematical calculation used. Common practice with oscillators is to use the zero line, but both 50 and 100 baselines tend to come up often.

Basic Terms for Oscillators

Baseline Crossing

When the oscillator crosses the baseline, a buy or sell signal is generated. If you were to combine the oscillator with trend analysis, the signal’s strength would be amplified. Therefore, signals that are triggered by intersecting the baseline should be in tandem with the prevailing direction of the trend.

Overbought/Oversold

Since some oscillators are bounded, they naturally come with both lower and upper borders. The most common boundaries are 0 and 100; that is to say, the tool oscillates on a range between 0 and a 100.

These bounded types of oscillators come with predefined overbought and oversold bounds.

Some of the most popular overbought and oversold bounds include 70/30 for RSI, 80/20 for Stochastics and 100/-100 for CCI.

If the oscillator goes above the overbought level (i.e. the upper bound), this indicates that the price has been trading at extremely high levels which means that opening a new long position would be quite risky.

Conversely, if the oscillator goes below the oversold level (i.e. the lower bound), this indicates that opening any new short positions may be too risky as prices are trading at extremely low levels.

Traders may stick to the above rules, except in the beginning stages of a new trend. Once a fresh trend arises, oscillators have a tendency to move into oversold and overbought spaces very fast, indicating that the trader may consider not to open new long or short positions. But in this case, that particular rule could be ignored.

Divergence

Another way of analysing oscillators is through divergence; a particularly valuable method, mainly when a trend has momentum and the oscillator has reached extreme levels. A divergence between the price and the oscillator is like a signal that the trend in question is nearing its end and either a reversal or a consolidation is highly probable. For instance, if the price is going in an upwards direction and forming higher tops and higher bottoms, but the oscillator does not form a higher top, then this is a so-called ‘negative divergence warning’ that a downside reversal is possible.

On the other hand, if the price is on a downward track, forming lower tops and lower bottoms on its way, and the oscillator doesn’t form a lower bottom, then this is a positive divergence signal that an upside reversal is likely.

In essence, divergence is an early-stage warning. It alerts the trader about a possible reversal before the actual reversal becomes visible. This is every trader’s dream but it’s important to remember that it is only a warning, not a guarantee and not a buy or sell signal! One must practice patience, and keep an eye on the price reversal before any new positions are opened. Never forget: price is the boss!

Conclusion

The majority of traders use oscillators. Their value is derived from the fact that they confirm trend directions, as well as signals for buy and/or sell opportunities. They also warn against extreme price levels and alert the trader when a current direction is nearing its end. Oscillators are also famous for giving traders a heads up about impending reversals before they even appear on the chart. Remember, oscillators should always be used together with price chart analysis.

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.