Asian stocks are mixed and US futures are in the red on Monday morning, kicking off the new trading week on a slightly risk-off note. Despite the buy-the-dip action in the latter half of last week, benchmark US stock indices remain off their respective record highs:

- Dow Jones = 1.14% lower since 7 May

- S&P 500 = 1.39% lower since 7 May

- Nasdaq 100 = 4.62% lower since 16 April

Investors are still having to digest the prospects of the global economic recovery.

China continues to take significant strides into the post-pandemic era, registering year- on-year gains in April for industrial production (9.8%) and retail sales (17.7%), while the unemployment rate moderated further to a better-than-expected 5.1%.

Across the Pacific, investors witnessed a lower-than-expected print for April retail sales data, suggesting that the easiest parts of the US economic recovery are over. The world’s largest economy may have to slog the rest of its way into the post-pandemic era. April’s major US economic prints, from nonfarm payrolls to inflation figures, bamboozled many economists.

This suggests a bumpy ride ahead for risk assets, as markets remain sensitive to the shifting narrative surrounding the global economic recovery, and the outlook for central bank policy adjustments.

Here’s what could influence market sentiment this week:

Monday, May 17

- Fed speak: Fed Vice Chair Richard Clarida, Atlanta Fed President Raphael Bostic

Tuesday, May 18

- Fed speak: Dallas Fed President Robert Kaplan, Atlanta Fed President Raphael Bostic

- Eurozone GDP

Wednesday, May 19

- FOMC minutes

- Fed speak: St. Louis Fed President James Bullard, Atlanta Fed President Raphael Bostic

- US President Joe Biden speech

- CPI: Eurozone, UK

Thursday, May 20

- China loan prime rate

- ECB President Christine Lagarde speech

- US weekly jobless claims

Friday, May 21

- Fed speak: Atlanta Fed President Raphael Bostic, Dallas Fed President Robert Kaplan, Richmond Fed President Thomas Barkin

- PMIs for US, Eurozone, UK

- UK retail sales

The reopening battle (GBPUSD)

Today, the UK will embark on step three of its 4-step “roadmap out of lockdown”, removing more of its social distancing measures. Across the pond, New York City, New Jersey and Connecticut will also resume more economic activities over the coming week.

It remains to see which is the stronger force: the optimism surrounding the UK economic recovery which has boosted the pound, or the US inflation fears that have helped the dollar regain ground.

That could determine whether GBPUSD can keep its head above the psychologically-important 1.40 level in the coming days.

Break it up you two (EURUSD)

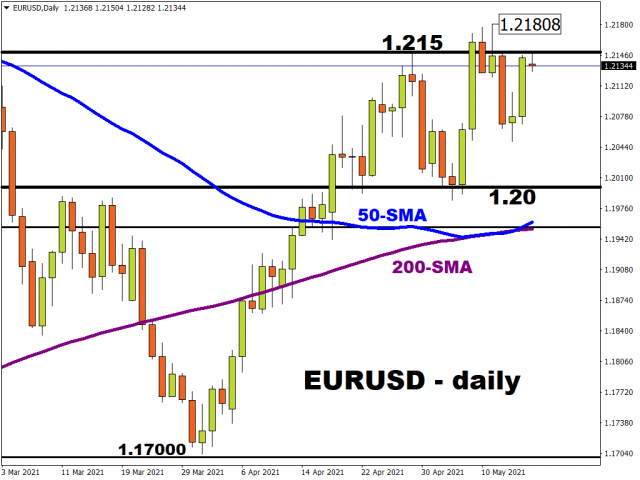

While many of us remain socially-distanced, the 50-day and 200-day simple moving averages for EURUSD were hugging each other all of last week, only for the 50-SMA to start pulling away above its 200-day counterpart.

Such a technical event could herald more gains for the world’s most traded currency pair.

Stronger-than-expected economic data out of the Eurozone this week could serve as the fundamental catalysts for more euro gains, as long as the dollar behaves and Treasury yields don’t go on another surge.

Commodity spotlight – Gold

Gold is currently testing its 200-day simple moving average as a resistance level, creating a larger gap above the psychologically-important $1800 mark. However, with its 14-day relative strength index flirting with overbought levels once more, a near-term pullback could be in order.

The latest FOMC minutes to be released this week, along with the scheduled Fed speak, could offer more clues about policymakers’ views on the US inflation outlook.

Further gains for the greenback on rising inflation fears could drag bullion back to sub-$1800 levels again.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.