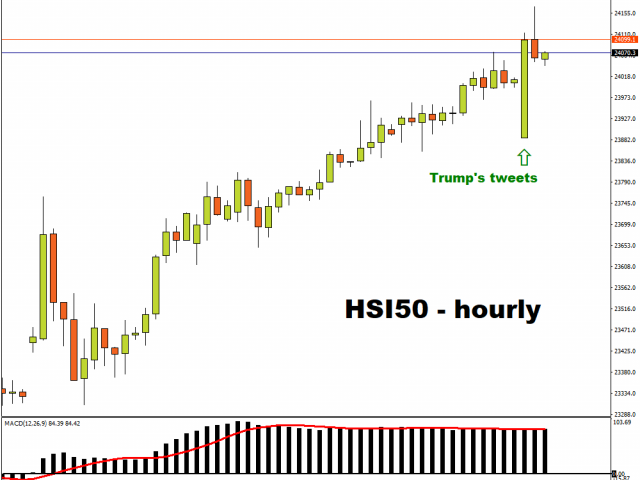

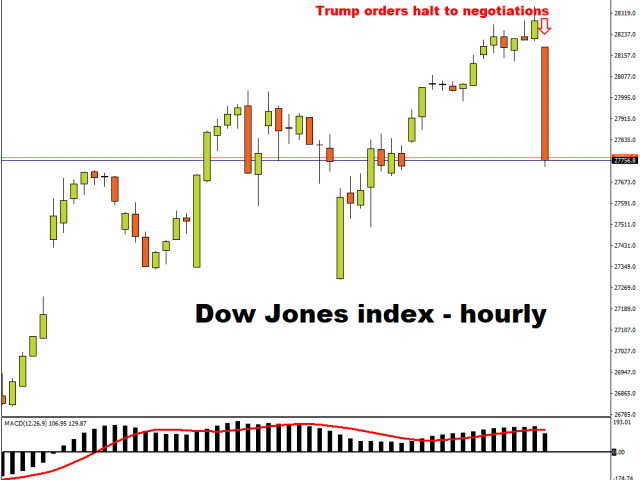

Asian stock indices are having mixed feelings to US President Donald Trump’s late-night tweets. After earlier demanding a halt to negotiations surrounding the next US fiscal stimulus package, President Trump then later outlined, on his Twitter feed, the terms that he would agree to immediately. POTUS said he is ready to approve $1200 stimulus checks, as well as more support for airlines and for small businesses via the Paycheck Protection Program.

US equity futures are fluctuating between losses and gains during the Asian morning trading session, after the S&P 500, the Nasdaq, and the Dow Jones index registered a Tuesday decline of over one percent each. The FXTM Trader's Sentiment remains net long on the US SPX 500 (Mini) and the US Tech 100 (Mini).

Following Trump’s subsequent tweets, the Hang Seng index is now leading Asia’s gains at the time of writing, up by 0.6 percent, although the Nikkei 225 as well as Southeast Asian indices are still in the red. The FXTM Trader's Sentiment is net short on the Hong Kong 50.

It now remains to be seen whether Democrats will take the bait and can reach an agreement for more fiscal stimulus for the US economy before the November presidential elections. Keep in mind that months of talks spearheaded by Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi have yielded naught, as both sides wrangled over a US$600 billion gap between their respective proposals.

Investors have been clinging on to expectations that another round of US fiscal stimulus was nigh. With Trump’s latest tweets, US stocks must now ascertain the likelihood that Democrats can reach across the political aisle and get a deal secured. Such an agreement could prompt global equities to chase further gains over the immediate-term.

Still, there are broader concerns that remain in play. Investors are likely to remain gripped by the political uncertainty leading up to the November 3rd elections, while aware of the risk that the final outcome could possibly be delayed for several weeks after. Also, the recovery in the US economy is evidently stalling, as highlighted by the waning recovery seen in last Friday’s US non-farm payrolls.

The world’s largest economy needs all the help it can get, both from the government and from the Federal Reserve. Fed Chair Jerome Powell had also issued a clarion call on Tuesday for more stimulus measures out of Congress, and said there’s a low risk of “overdoing it”, to which President Trump responded via Twitter, “True!”.

At least investors can take heart from the notion that, regardless of who ultimately gets to occupy the White House for the next four years, both monetary and fiscal policy are expected to remain supportive of equities for a long while more.

In short, more help from Congress is on the way. Investors just have to wait, for a still unknown duration, to see its approval and its eventual positive impact on the economy and on stock markets.

FOMC minutes could spur more losses for US Dollar

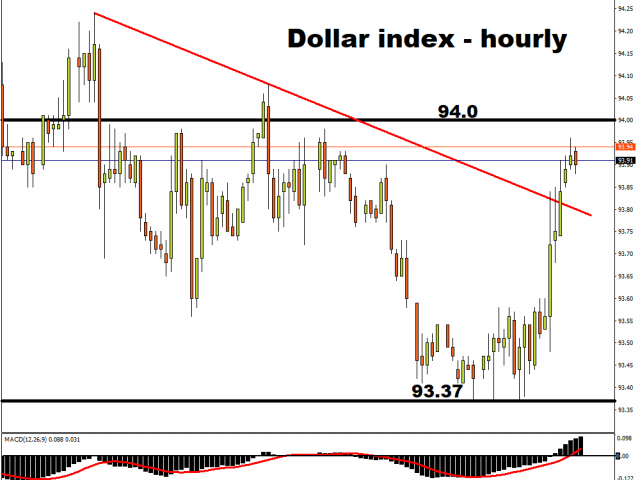

The Dollar index (DXY) pared gains as investors return to hope that another round of US fiscal stimulus could indeed be approved in the near-term. However, such losses are likely to be limited, until such an agreement is formalized.

Given such dynamics, expect the US Dollar to remain supported in the absence of more US fiscal support. However, with the FOMC September meeting minutes set to be released later on Wednesday, should investors get clearer signs as to how the Fed intends to juice up US inflationary pressures, that could prompt the Greenback to ease further towards the 93.37 low.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.