28.04 @ 13:10

By Han Tan Chief Market Analyst at Exinity Group

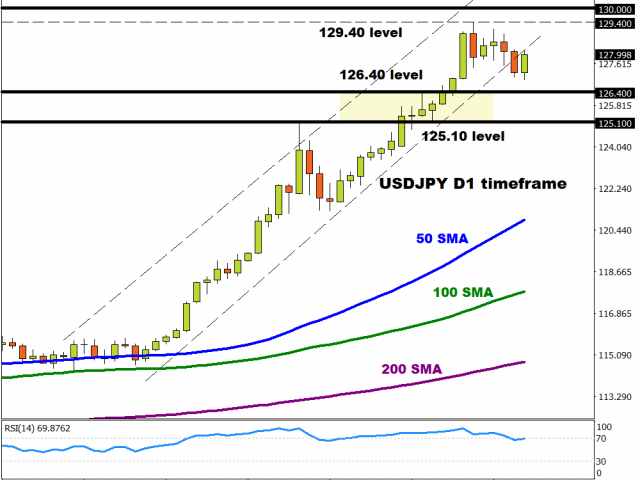

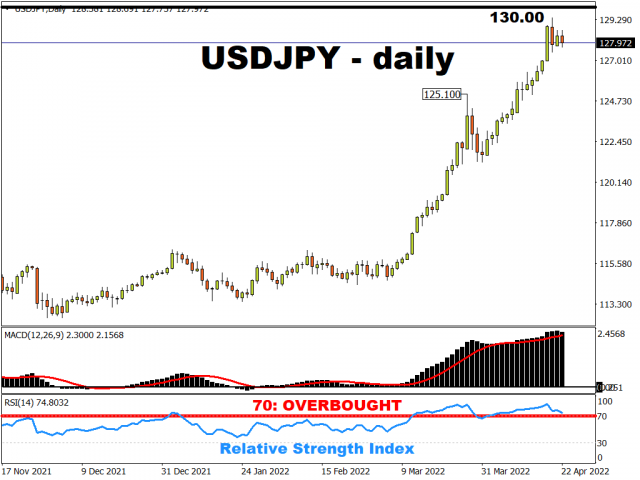

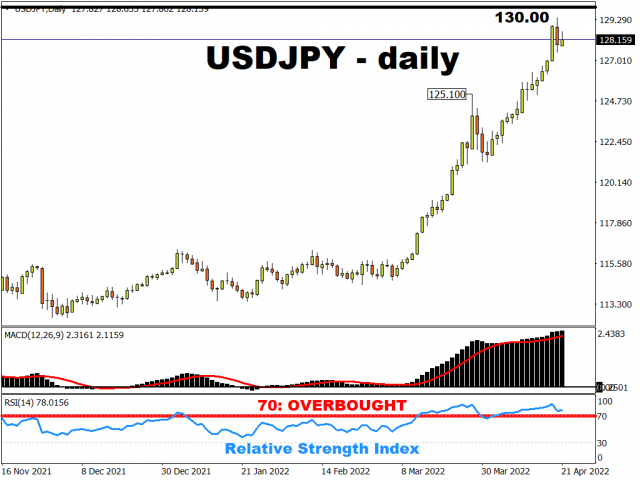

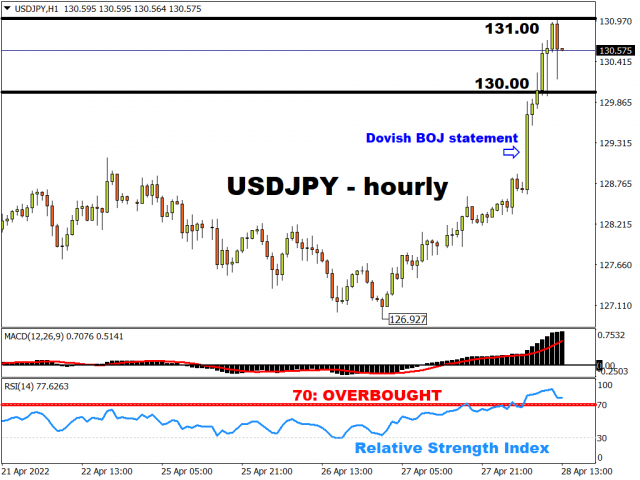

USDJPY briefly touched the 131 level for the first time since 2002, before the currency pair was resisted at that psychologically-important handle.

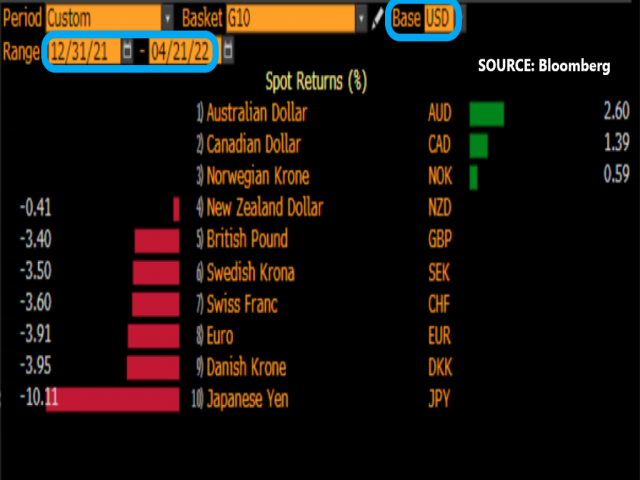

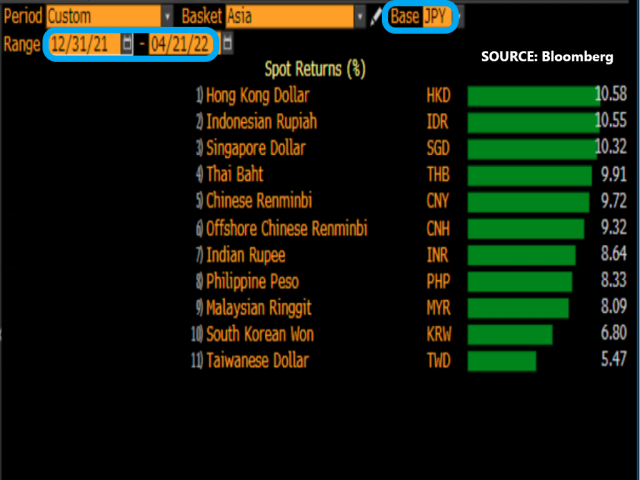

The dovish Bank of Japan’s statement today had wrought more weakness on the Japanese Yen, which fell against all of its G10 and Asian peers today.

The equally-weighted JPY Index is now in the midst of erasing most of its gains from the past week.

Note that the JPY index measures the Yen’s performance against:

- US dollar

- British Pound

- Euro

- Swiss franc

- Australian dollar

- New Zealand dollar

… all in equal weights.

What did the Bank of Japan say?

The BOJ stuck with its dovish guns at its policy meeting today.

That means the central bank is pledging to keep buying Japanese bonds in order to keep those bond yields low, specifically preventing the 10-year bond yields from rising above 0.25%.

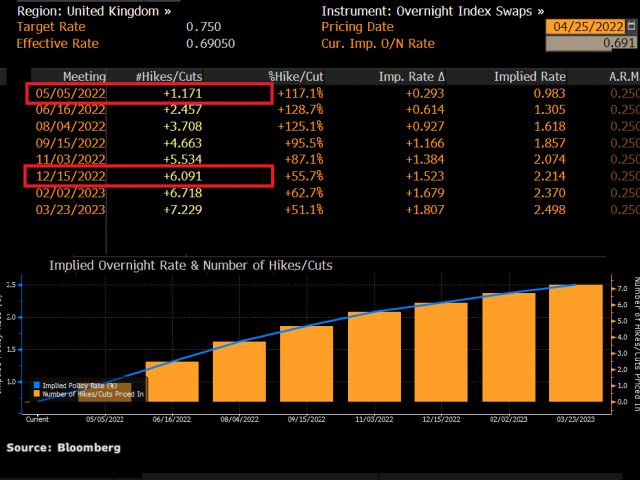

This is important because it underscores how much the Bank of Japan is deviating from the rest of the world (with China’s central bank being another notable exception to the global trend of policy tightening).

Most other central banks are trying to raise interest rates and wind down their bond purchases (letting their yields rise in the process) – all in the name of combatting swelling inflation.

Another major signal out of the BOJ today: central bank governor Haruhiko Kuroda said Japan’s interest rate could go even lower if Covid-19 continues to hamper the Japanese economy!

Keep in mind that the BOJ’s policy balance rate is currently at negative 0.1%, already at odds with the rate hikes happening around the world.

(Another notable exception in the negative rates camp: the European Central Bank’s deposit rate is at minus 0.5%, although the ECB is getting ready to join the rate-hikes bandwagon as well).

The policy and yields chasm is widening between the BOJ and most other central banks.

With yields on 10-year US Treasuries now above 2.8%, investors are sending their money across the Pacific towards the US dollar as they chase those higher returns/yields, at least higher than what Japan has to offer.

Dollar rush post-dovish BOJ sends waves across FX universe

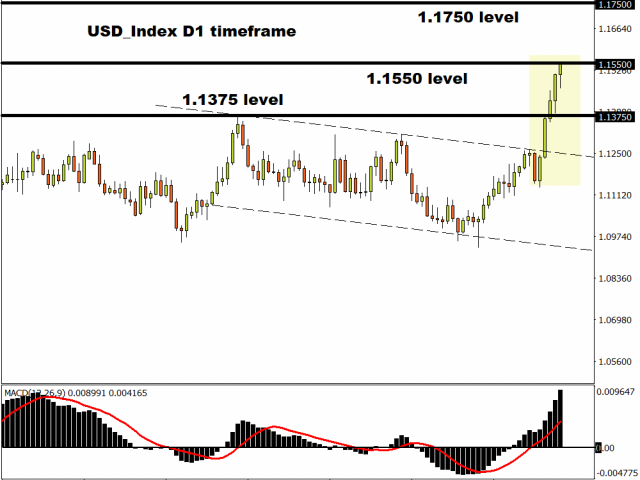

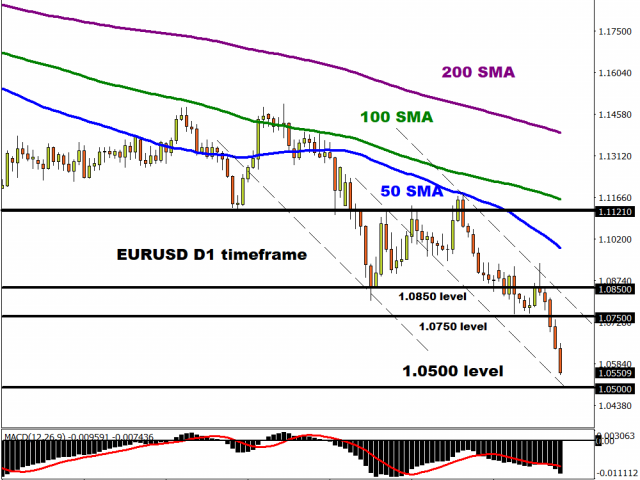

As investors swarm to the US dollar, that is also weighing on most other currencies’ respective performances against the greenback too.

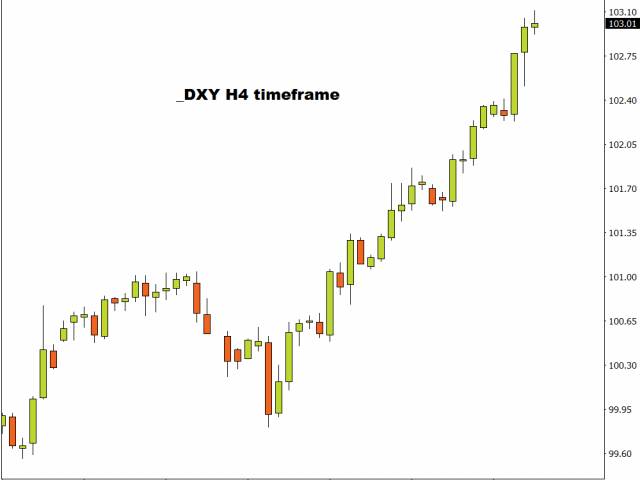

Note how the benchmark dollar index (DXY) soared to a 5-year high, going past its pandemic peak and attaining the 103.7 mark not seen since January 2017.

Note that the Japanese Yen accounts for 13.6% of the DXY.

Where to next for USDJPY?

With more demand for the US dollar and less demand for the Japanese Yen comes potentially greater heights for USDJPY, barring a move by Japanese policymakers to curb the yen’s decline.

Consider how even back in 2002, when USDJPY surpassed 135, Japanese policymakers didn’t intervene.

Tokyo may be willing to tolerate such weakness in the Yen, despite making imported goods and services more expensive for Japanese households and businesses, and policymakers might instead prefer other measures than currency intervention to support the domestic economy.

With that in mind, a weekly close above 130 could all but pave the way to 135 for USDJPY as long as this policy and yields divergence continues, unless Japanese policymakers start intervening.

Until then, according to CFTC data, asset managers have recently extended their record amount of short bets on the Japanese Yen, expecting more weakness for JPY ahead.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.