Most Asian markets are modestly in the green overnight after the rebound in stock markets Stateside. The S&P500 enjoyed its best day since March with performance driven by cyclical stocks, while small caps gained some 3%. European equities have opened up positively and US futures are mixed at present.

Monday’s volatility has abated for the time being though summer markets and thin liquidity can always throw up new curveballs. The VIX, sometimes known as Wall Street’s fear gauge, has dropped back from above 25 to below 20.

S&P marker

The recent low in the S&P500 at 4,233 is now significant as a clear support line in the sand. The scale of yesterday’s rebound means any renewed weakness through this level could lead to increased volatility and further market ructions. The 50-day moving average also held up the main US equity index and has acted as reliable support this year. If markets stabilise into the end of the week, dip buyers and the bulls may look to push on higher. A more protracted global recovery means policy stimulus remains in place for longer.

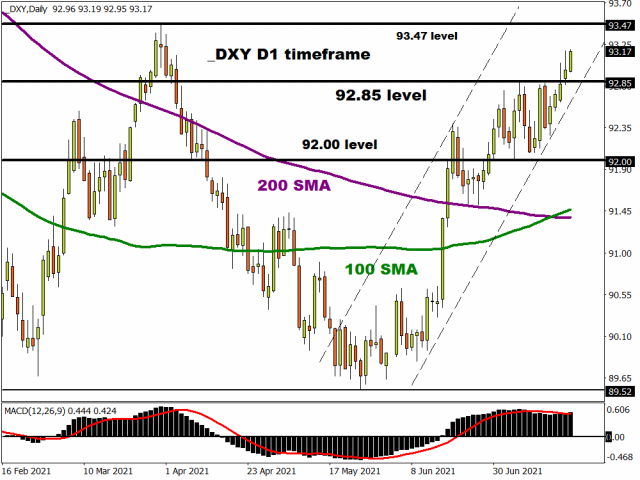

USD carries on higher

The main dollar index (DXY) hit 93.19 this morning, its best level since the start of April.

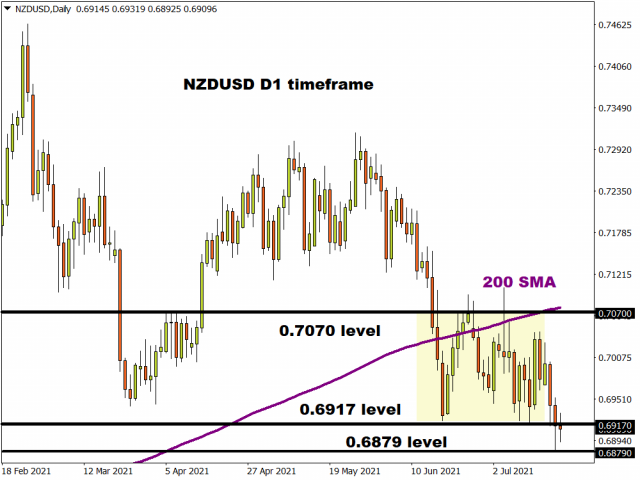

While equity markets are trying to regain a footing, the strength in the greenback as well as in JPY does give off mixed signals. Indeed, AUD/USD and NZD/USD are pushing to new lows and levels not seen since November.

The more hawkish central banks reside in the cyclical FX space (CAD, NZD and NOK) so many market watchers see the dip here as a correction more than something more long term. It’s a question that will be answered over the following sessions and weeks no doubt!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.