Daily Market Analysis and Forex News

Brent advances ahead of OPEC+ decision

- Brent enters squeeze ahead of OPEC+ decision

- Will cartel deliver or disappoint?

- Supply cuts from OPEC+ could trigger 400-point rally

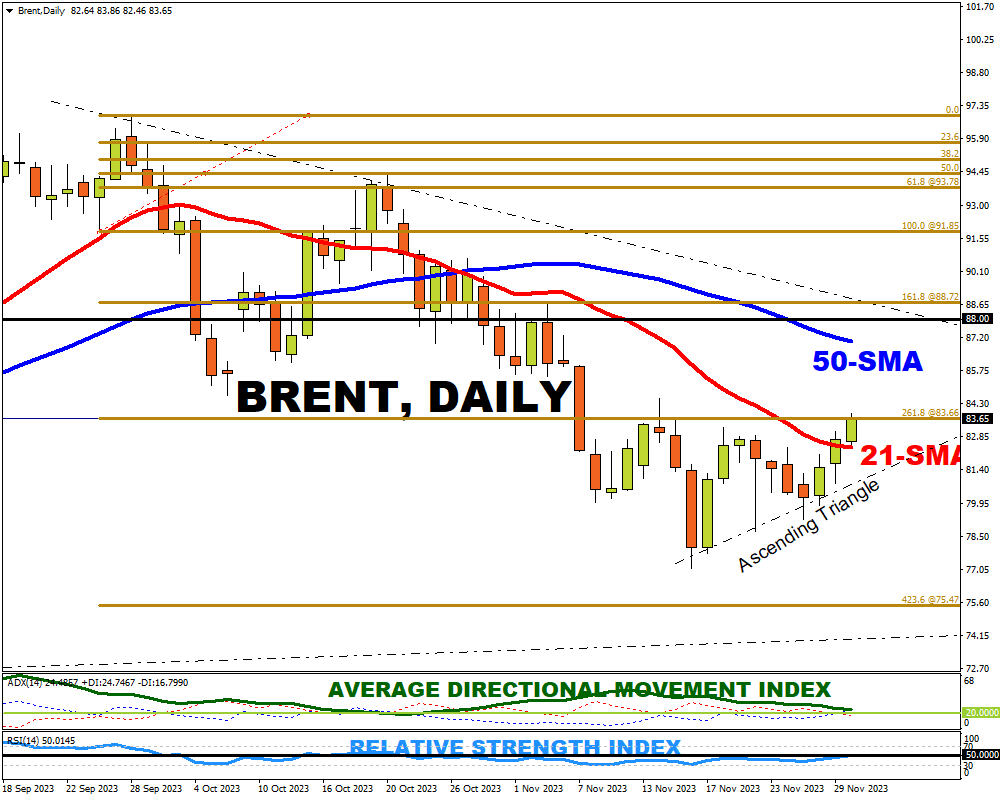

- Brent in ascending triangle and above 21-day SMA

Oil extended gains on Thursday as market focus shifted towards the OPEC+ meeting that was postponed from last week due to internal disagreements.

Brent prices punched above $83 this morning after jumping almost 4% over the last two sessions after a severe storm in the Black Sea region sparked supply concerns. While this development has kept oil prices buoyed, the looming virtual OPEC+ meeting today is likely to influence the global commodity’s outlook.

Given the sharp selloff in oil prices since mid-September, OPEC+ could make further changes to an agreement that already limits supply into 2024. Indeed, oil has been hammered by concerns about weaker economic growth and expectations of a supply surplus in 2024. However, discord over output quotas for African oil-producing countries could act as an obstacle that leads to further delays in negotiations.

- Oil prices may weaken if the cartel fails to reach an agreement on production quotas for 2024 or disappoint market expectations for deeper supply cuts.

- Should OPEC+ move ahead with deeper supply cuts, this could lend oil bulls fresh support – pushing the global commodity higher as a result.

Technically speaking...

Since the November 16th low at $77.08, the black gold has rallied within an ascending triangle for over 600 points and as of the time of writing sits above its 21-day SMA at around $83.

According to Thomas Bulkowski in his book “Encyclopedia of Chart Patterns”, ascending triangles perform better with upward breakouts, with a 70% chance of meeting their breakout target, and a 17% breakeven failure rate.

Brent bulls may take any deeper production cuts as bullish and rally to the following key resistance levels.

• $83.66: the 261.8 Fibonacci level

• Its 50-day SMA

• $88: A significant price level

The Fibonacci level is drawn from the September 26 low to the September 28 high on a daily time frame.

However, if widely reported disagreements over these quotas continue, we could see brent oil prices fall to test the following support levels.

• $81.67: the 61.8 Fibonacci level

• $81.00: the rising trend line capturing lows from November 16th.

• $75.47: the 423.6 Fibonacci level

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.