Daily Market Analysis and Forex News

EURUSD bulls gains momentum ahead of ECB

As the countdown draws closer to the European Central Bank (ECB) meeting, investors are still digesting the Federal Reserve’s (Fed) policy decision overnight.

The Fed raised interest rates by 25 basis points as widely expected but refrained from giving any clear indications on whether this would be the final move.

Indeed, Fed Chair Jerome Powell struck a neutral tone, stating that a “wait-and-see” approach would be adopted for future meetings. On top of this, the Fed emphasized the importance of economic data when making monetary policy decisions. While the central bank expressed concerns about inflation, there was optimism over the US economic outlook with a ‘soft landing’ possible.

Traders are currently pricing in only a 20% probability of a 25-basis point hike in September with this jumping to 41% by November’s policy meeting. These expectations are likely to be influenced by the multiple jobs and inflation reports published before the next Fed meeting in September.

Before we unpack what to expect from the ECB meeting this afternoon, it is worth keeping an eye on the Bank of Japan policy meeting on Friday.

The BoJ is widely expected to retain its ultra-monetary policy on Friday. However, much of the focus will be on the fresh economic projections for inflation and growth. These may influence expectations around whether the central bank tweaks its yield curve control (YCC) down the line. Expect the Yen to be influenced by the pending BoJ meeting, especially if there are any hints of a policy change in the future.

Redirecting our focus back on the ECB meeting, the central bank is widely expected to raise rates by 25 basis points this afternoon.

However, the outlook beyond July remains less certain with investors turning to Christine Lagarde for fresh clarity. Given the growing concerns over Europe’s economic outlook as data disappoints, the end of rate increases is fast approaching. But inflation remains well above the ECB’s 2% target despite cooling at 5.5% in June – its lowest level since January 2022.

Whatever the outcome of the ECB meeting, it is likely to influence the EURUSD.

Taking a deep dive into the technical..

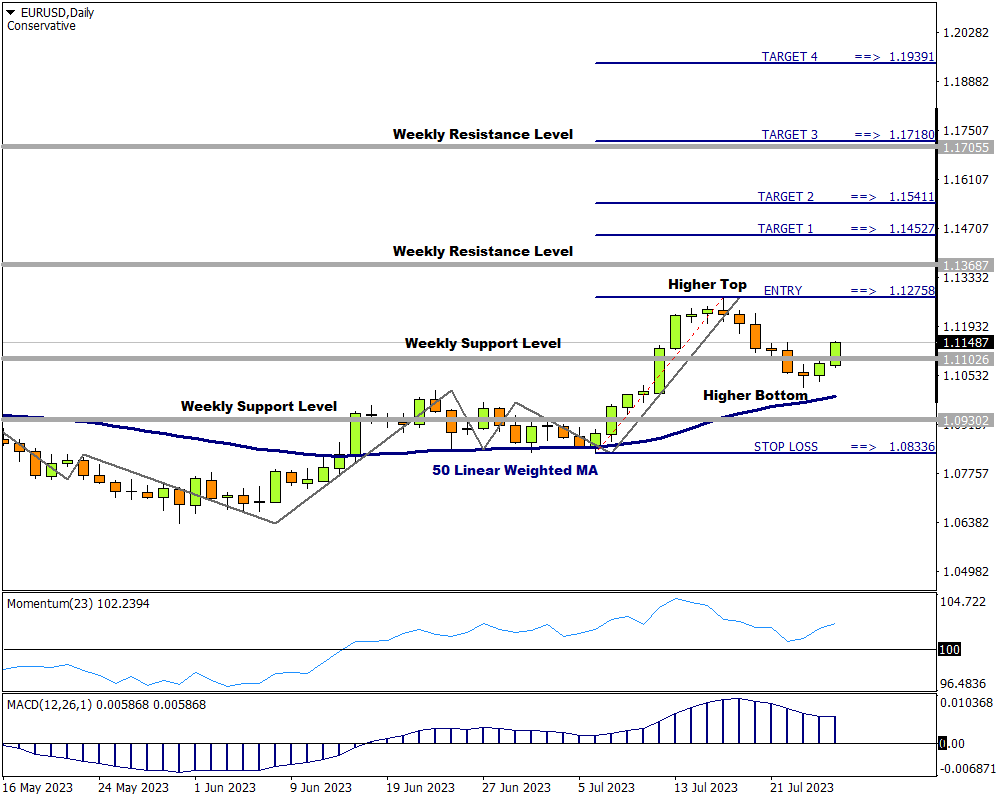

The EURUSD has been gaining momentum on the daily timeframe for some time.

Bulls broke out of a ranging phase at the beginning of July but after an initial charge, bears furiously countered with a strong pullback. Bulls countered by breaking through a weekly resistance turned support level on 27 July and this might affect the overall momentum in the market.

A possible confirmation of this scenario is that the price is above the 50 Linear Weighted Moving Average and both the MACD and Momentum oscillators are in bullish terrain.

If the market manages to break through the 1.12758 price level and push beyond the weekly resistance, four potential price targets can be calculated from there.

Attaching the Fibonacci tool to the higher top at 1.12758 price level and dragging it to a bottom that formed on 6 July at 1.08336, the following targets can be established:

The first target is possible at 1.14527 (Target 1) if the bulls can sustain their momentum through the next weekly resistance level.

The second price target is likely at 1.15411 (Target 2).

The third price target is probable at 1.17180 (Target 3) if yet another weekly resistance level is reached.

The fourth price target can be expected at 1.19391 (Target 4).

If the bears intervene at any time and succeed in stopping the bullish advance, this could cause the price to depreciate and any break of the 1.08336 price level will invalidate the long setup and trigger a sell signal.

The above scenario is based on the FXTM Signals that are posted twice a day (before the London and New York sessions) for all FXTM clients to follow. This can be accessed from inside the MyFXTM profile under Trading Services... FXTM Trading Signals.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.