Daily Market Analysis and Forex News

Trade Of The Week: Gold Primed For Another Breakout?

Gold prices have kicked off the new week still nursing deep wounds inflicted from last Friday’s painful selloff.

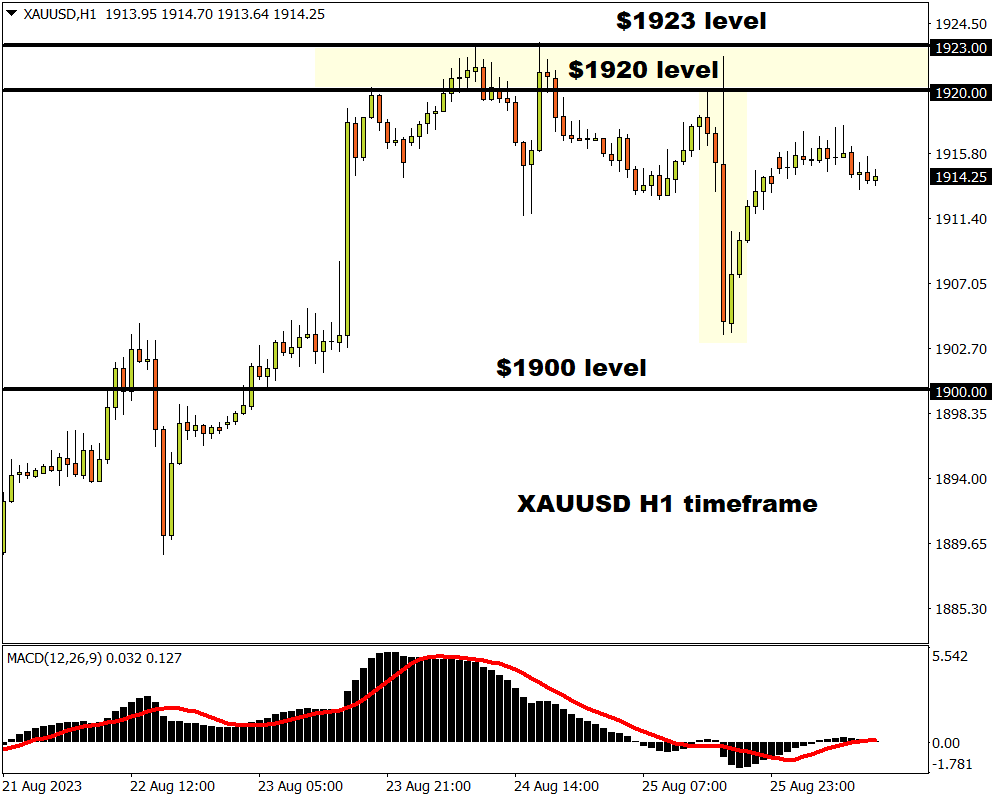

The precious metal's appeal took a hit following hawkish remarks delivered by Federal Reserve Chair Jerome Powell at Jackson Hole. With his comments leaving the doors open for further rate increases, gold found itself capped around $1920 as the dollar rose along with Treasury yields.

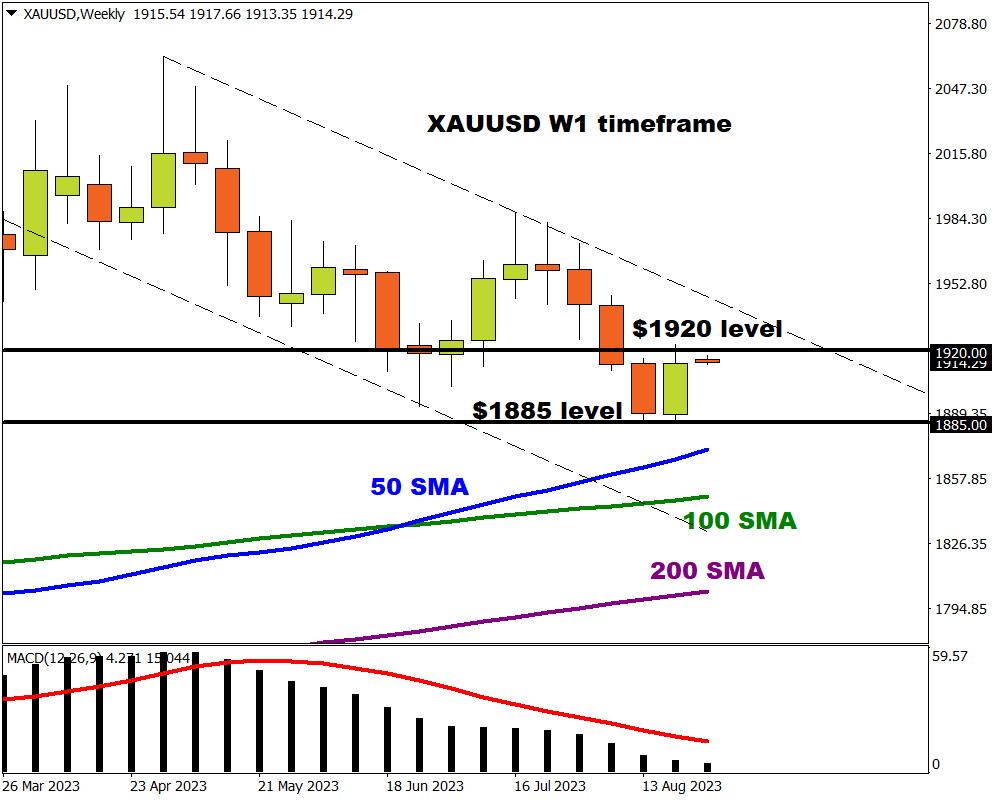

Gold is down roughly 2.5% month-to-date. Despite this, bulls and bears remain engaged in a fierce tug of war with prices almost unchanged since the start of Q3. Taking a quick look at the technical picture, the precious metal could experience a rebound or dead cat bounce with key resistance at $1920 and support at $1885.

A major breakout could be on the horizon and here are 4 reasons why:

1) US Data dump

With the Federal Reserve's recent shift to data dependency, every release of US economic data is of paramount importance. These data points will play a critical role in determining whether the Fed will raise rates one last time in 2023.

As a result, close attention will be paid to upcoming releases such as US August consumer confidence, US Q2 GDP (2nd estimate), and US weekly initial jobless claims to gauge the health of the US economy.

- Gold prices may appreciate on a weaker dollar if the overall data disappoints and caps expectations around the Fed keeping rates higher for longer.

- Gold could depreciate on a stronger dollar should the overall US economic data exceed market forecasts and fuel bets around higher US interest rates.

2) US July PCE report

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure will be closely scrutinized by investors, especially after the central bank stressed that incoming data would influence monetary policy decisions.

Markets expect the July PCE report to show headline prices remained steady at 0.2% month-over-month with the core PCE deflator also forecast to remain unchanged at 0.2% MoM. The core personal consumption expenditures price index for projected to rise 4.2% year-over-year in April, up from the 4.1% seen in June.

Ultimately, further signs of easing inflationary pressures may support gold prices as rate hike bets cool. Traders are currently pricing in a 22% probability of a 25 basis point hike in September with this jumping to 67% by November, according to Fed funds futures.

3) US August NFP report

Fasten your seatbelts because the US nonfarm payrolls report on Friday has the potential to rock gold prices.

Markets expect the US economy to have added 168,000 jobs in August, while the unemployment rate is seen remaining unchanged at 3.5%. Given how markets remain sensitive to anything relating to the US economy and rate hike expectations, this jobs report could trigger volatility across the board.

- Gold prices may appreciate if the August NFP report prints below the 168k market forecast, complemented by a higher unemployment rate. This combo may fuel speculation around the Fed being done with rate hikes, offering an opportunity for gold bulls to charge.

- Gold prices may depreciate if the August NFP reports exceed markets expectations with the unemployment rate moving lower. This scenario could strengthen the argument around the Fed raising interest rates one more time this year.

4) Technical forces

Despite pushing back above the 200-day SMA, gold bears still maintain some control on the daily charts.

Prices are trading below the 50 and 100-day SMA while the MACD trades to the downside. Bear may return to the scene if prices sink back below the 200-day SMA with $1885 acting as the first key level of interest. Weakness below this level may open a path towards $1870. Should prices experience a breakout above $1920, bulls could target $1935 and $1957 where the 100-day SMA resides.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.