Daily Market Analysis and Forex News

Week Ahead: EURUSD bear flag waits for fresh catalyst

*Note: This report was written before the US NFP data was published*

- Euro could see volatility next week thanks to EU data dump

- Powell remarks could trigger move in USD

- EURUSD bear flag waits for fresh spark on D1 charts

- Key levels of interest found at 1.0690, 1.0530 and 1.0450

Caution remains the name of the game as the key US jobs report this afternoon (Friday, 3rd November) approaches.

Even with the growing anticipation, some keen investors may be keeping tab on what’s to come in the week ahead:

Monday, 6th November

- EUR: Eurozone S&P Global Services PMI, Germany factory orders

- JPY: BoJ September meeting minutes

- GBP: BoE chief economic Huw Pill speech

Tuesday, 7th November

- CNH: China trade, forex reserves

- AUD: RBA rate decision

- EUR: Eurozone PPI, Germany industrial production

- JPY: Japan household spending

- USD: US trade, Kansas City Fed President Jeff Schmid speech

Wednesday, 8th November

- EUR: Eurozone retail sales, Germany CPI

- GBP: BOE Governor Andrew Bailey speech

- USD: US wholesale inventories, New York Fed President John Williams speech

- WSt30_m: Walt Disney earnings

Thursday, 9th November

- CNH: China CPI, PPI, money supply, new yuan loans

- GBP: BOE chief economist Huw Pill speaks

- USD: US initial jobless claims, Atlanta Fed President Raphael Bostic, Richmond Fed President Tom Barkin, Fed Chair Jerome Powell speech

Friday, 10th November

- JPY: Japan M2 money stock

- NZD: New Zealand PMI

- EUR: ECB President Christine Lagarde speech

- GBP: UK industrial production, GDP

- USD: University of Michigan consumer sentiment, Fed speak

Our focus falls on none other than the world’s most traded currency, which is set to be influenced by numerous reports from Europe and the United States, along with speeches from Fed officials including Jerome Powell.

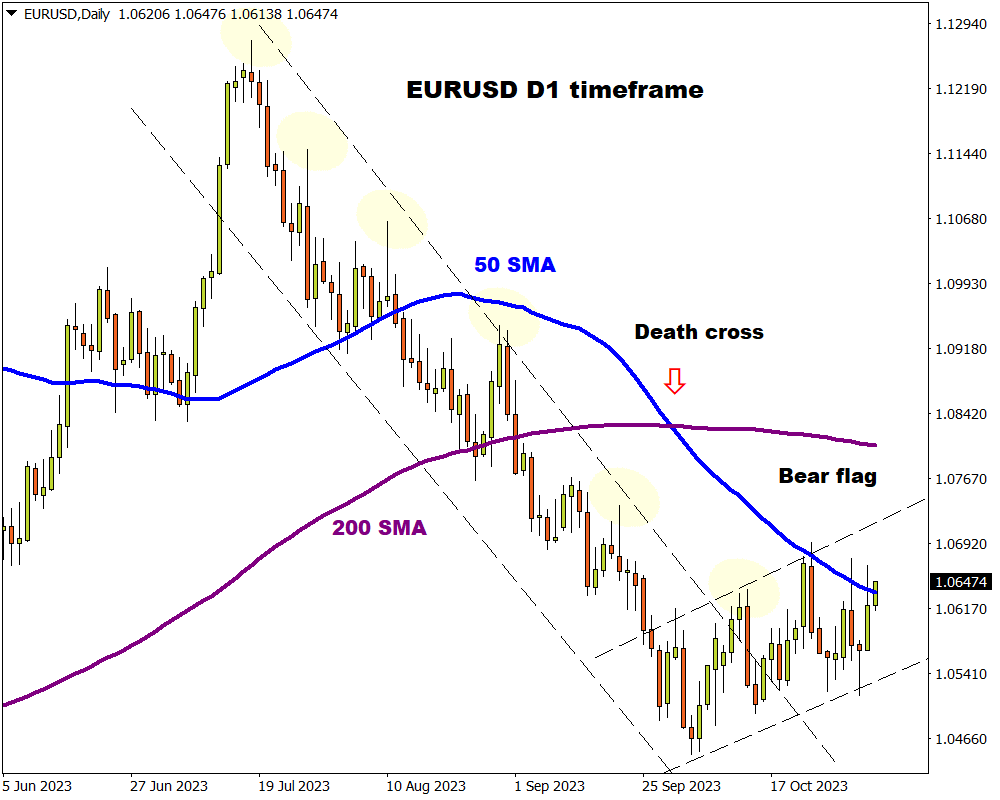

Before we discuss what to expect from the EURUSD next week, it is worth noting that the currency pair is under pressure with a bearish flag pattern in play on the daily charts.

A bearish flag is a candlestick chart pattern that signals the continuation of a downtrend once the technical bounce is finished.

A fresh fundamental spark could be required to trigger a significant technical move on the EURUSD. Here are 3 potential catalysts to keep an eye on in the week ahead:

-

EU data dump

The euro could see heightened volatility due to top-tier data from Europe in the first half of the week.

Concerns remain elevated over Europe’s outlook with economic growth contracting 0.1% in the third quarter of 2023. However, inflation has fallen to its lowest level in more than two years – strengthening the case for ECB doves and boosting expectations that the ECB will not raise rates further.

Investors will be paying close attention to some key data pieces ranging from Eurozone PMI’s, PPI and retail sales along German factory orders and industrial production among other significant releases from the region.

- The EURUSD could find itself under fresh selling pressure if overall economic data disappoints and boosts speculation around rate cuts in the first half of 2024.

- Euro bulls may draw support from strong economic data, especially if this supports expectations around rates remaining higher for longer

As of writing, traders are currently pricing in an 82% probability of a 25-basis point ECB cut by April 2024.

-

Powell remarks + US data

The Fed not only left interest rates unchanged at its November meeting but Powell also hinted that the central bank could be done with its most aggressive tightening cycle in 40 years.

Powell expressed optimism over the US economy but still warned that there was a long way to go on the inflation fight. Speeches from various Fed officials will be in sharp focus but on Thursday the spotlight shine on Powell as he participates in a panel on monetary policy challenges at the IMF’s annual research conference in Washington. It will be wise to keep an eye on US economic data which could influence monetary policy expectations.

- Should Fed officials strike a dovish tone and overall US data disappoint, this could strengthen the argument around the Fed being done with hikes – supporting the EURUSD as a result amid dollar weakness.

- If Powell along with Fed officials sounds more hawkish and US data beats forecasts, expectations could rise around one more Fed hike before the end of 2023, pulling the EURUSD lower as the dollar strengthens.

As of writing, traders are pricing in a 32% probability of a 25 basis point Fed hike by the end of 2023.

-

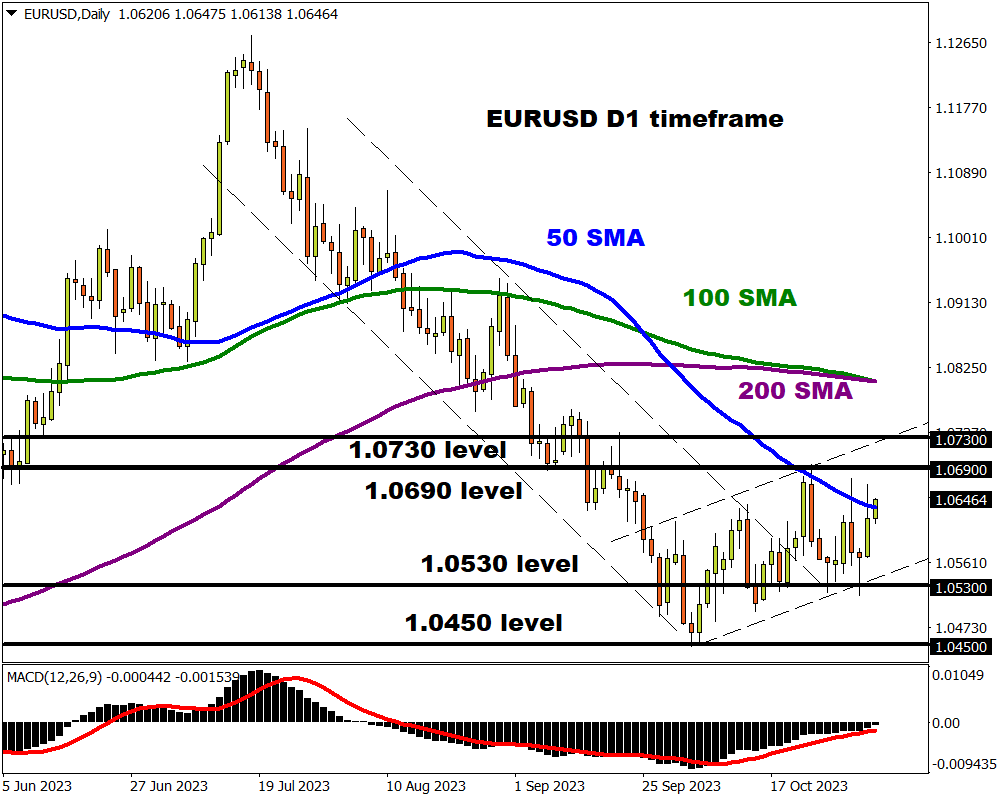

Technical forces: bear flag

A bear flag technical pattern could be in play on the daily charts with prices flirting around the 50-day SMA as of writing. Prices are trading below the 100 and 200-day SMA while the MACD trades below zero. Key resistance can be found at 1.0730 and 1.0690. Support may be identified at 1.0530 and 1.0450.

- Sustained weakness below 1.0730 may encourage prices to slip back towards 1.0530 before targeting the 1.0450 level.

- Should prices break above 1.0730, this may trigger a move towards the 200-day SMA around 1.0800.

According to Bloomberg's FX model, there is a 74% chance that the EURUSD will trade between 1.0539 and 1.0768 range over the coming week.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.