Tìm hiểu

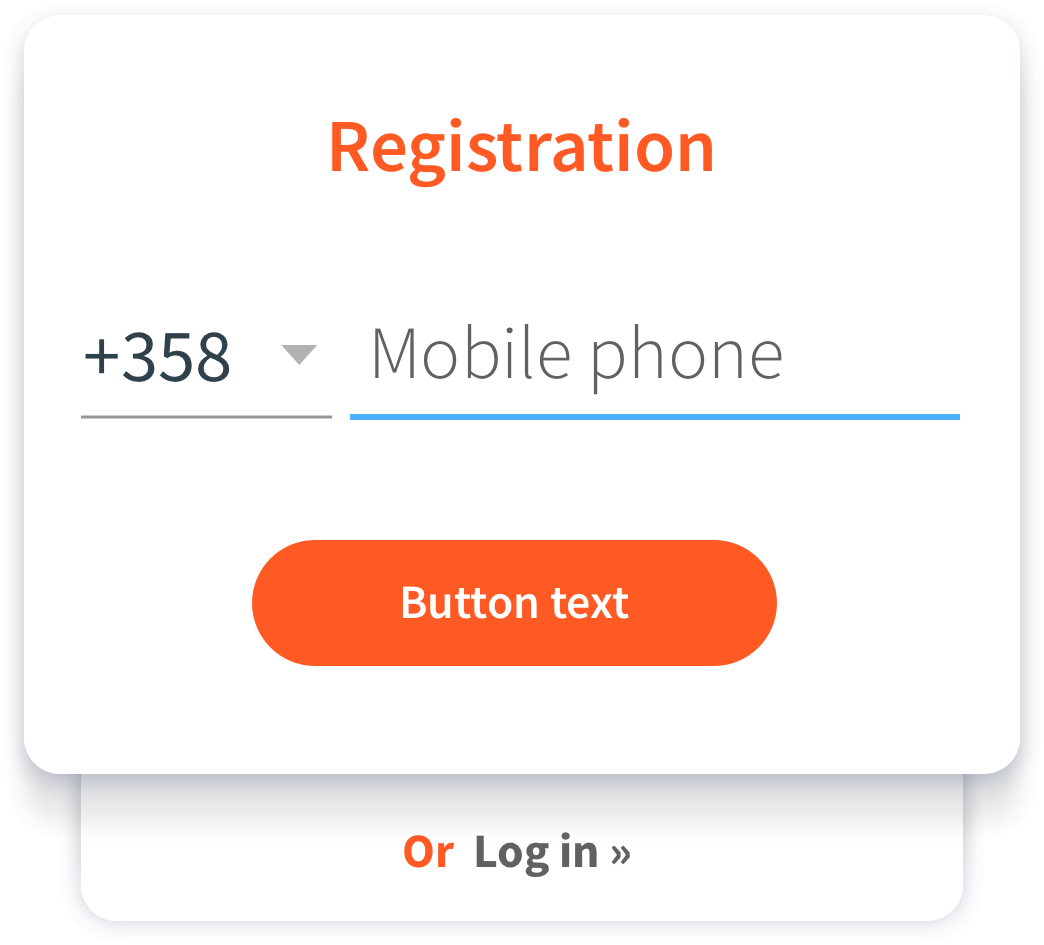

- Tạo tài khoản demo MIỄN PHÍ

- Hướng dẫn từng bước & bài viết

- Hội thảo qua web & hội nghị chuyên đề tại địa phương

- Người quản lý tài khoản của bạn

Giao dịch

- Chênh lệch thấp

- Thực hiện giao dịch siêu nhanh

- Công cụ giao dịch forex công nghệ cao

- Chống rủi ro & bảo mật tối ưu

Đầu tư

- Không cần phải là nhà giao dịch kinh nghiệm

- Có rất nhiều chiến lược để giao dịch theo

- Có được lợi nhuận bất cứ khi nào Nhà quản lý Chiến Lược có

- Hoàn toàn kiểm soát số tiền đầu tư của bạn

FXTM Invest

Giao dịch theo. Tiết kiệm. Phát triển.

Tìm nhà giao dịch phù hợp để giao dịch theo

Chọn những nhà giao dịch kinh nghiệm, giao dịch theo họ và ngồi chơi trong khi họ làm mọi việc cho bạn. Danh mục đầu tư của bạn sẽ tăng trưởng theo mỗi giao dịch thành công, trong khi bạn lại có thể tiết kiệm được thời gian và công sức.

Hiệu quả hoạt động trước đó không đảm bảo kết quả trong tương lai

Phân tích thị trường hàng ngày chuyên sâu

Tin tức mới nhất

USDJPY rises to 20-year high on dovish BOJ

Mid-Week Technical Outlook: Dollar Dominates FX Space

Học cách giao dịch

Các hội nghị chuyên đề & hội thảo qua web miễn phí sắp tới

Hội thảo qua web

Tăng cường giao dịch của bạn bằng tài liệu đào tạo miễn phí của FXTM

Hội thảo

Tích lũy kiến thức giao dịch đẳng cấp thế giới từ đội ngũ các chuyên gia của FXTM

FXTM luôn hướng tới việc đào tạo các nhà giao dịch theo cách chuyên nghiệp nhất, và đó là lý do vì sao chúng tôi cung cấp rất nhiều video ngắn cũng như các tài liệu chuyên sâu về giao dịch. Hãy khám phá các khái niệm trong giao dịch Forex và phân tích kỹ thuật bất cứ lúc nào bạn muốn.

Báo giá Fx & kim loại quý trực tiếp

Giao dịch kim loại quý và thị trường tiền tệ